A Trusted, Step-by-Step Overview by Nevis Style Realty

Nevis offers a compelling combination of lifestyle appeal and long-term investment fundamentals:

Stable legal system based on English Common Law

No restrictions on foreign ownership (with Alien Landholding License)

No capital gains tax, inheritance tax, or wealth tax

Attractive real estate pricing relative to comparable Caribbean markets

Eligibility for Citizenship by Investment through approved developments

Low-density development and strong privacy protections

These factors make Nevis particularly attractive to second-home buyers, retirees, investors, and globally mobile families.

Before beginning your search, NSR works with you to clarify:

Intended use (private residence, rental income, CBI, or land banking)

Budget range and financing structure

Preferred locations (beachfront, hillside, resort, residential)

Timeline for purchase and intended holding period

This ensures a focused, efficient property selection process and avoids misalignment later in the transaction.

Once suitable properties are identified, NSR will:

Arrange virtual or in-person viewings

Provide comparable market insights

Discuss rental performance (where applicable)

Review zoning, access, and development potential

When you are ready to proceed, an Offer to Purchase is submitted outlining price, deposit terms, and conditions.

Upon acceptance of an offer:

A Sale and Purchase Agreement is prepared by local attorneys

A deposit (typically 10%) is paid and held in escrow

The transaction becomes legally binding, subject to conditions

At this stage, buyers typically engage their own attorney, though NSR can introduce reputable local legal professionals.

Non-nationals are required to obtain an Alien Landholding License to own property in Nevis.

Key points:

Application submitted after signing the sale agreement

Processing time generally ranges from 2–4 months

Government license fee is typically 10% of the purchase price

Buyers may take possession once approval is granted

NSR coordinates closely with attorneys to ensure the application process proceeds efficiently.

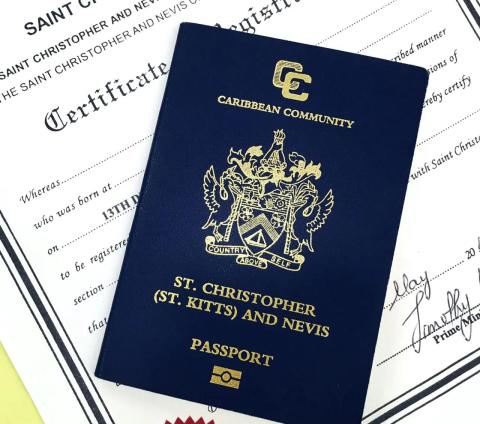

Certain properties qualify under the Citizenship by Investment Program (CBI), subject to current government regulations.

Important considerations:

Only government-approved developments qualify

Private home eligibility is limited and price-restricted

Condominiums often provide more accessible entry points

Due diligence and government fees apply

NSR works alongside licensed CBI service providers to ensure compliance and transparency throughout the process.

In addition to the purchase price, buyers should budget for the following standard acquisition costs associated with purchasing property in Nevis. These costs are typical and help ensure a secure and properly registered transaction.

1. Legal Fees

Legal fees are payable to the buyer’s appointed attorney and generally cover due diligence, preparation and review of the Sale and Purchase Agreement, conveyancing, and registration of title.

Estimated cost: up to 2.5% of the purchase price

Note: Legal fees are negotiable and may vary depending on transaction complexity

2. Surveyor Fees

A licensed surveyor may be engaged to confirm property boundaries, access, and site conditions, particularly for land purchases or development projects.

Estimated cost: approximately US$1,500

Note: Fees may vary based on property size, terrain, and scope of work

3. Assurance Fund Contribution

The Assurance Fund is a statutory contribution payable upon transfer of title. It provides government-backed protection related to the registered ownership of property.

Cost: 0.2% of the purchase price

Important Note:

These figures are provided as a general guide. Nevis Style Realty works closely with attorneys and service providers to help buyers understand costs upfront and avoid unexpected expenses.

If you would like a personalized cost estimate based on a specific property, our team would be happy to assist.

Once conditions are satisfied:

Balance of funds is paid

Title is transferred and registered

Buyer receives the registered Deed of Conveyance

NSR remains involved through completion to ensure a seamless closing.

Nevis Style Realty offers continued support after purchase, including:

Property management and rental oversight

Introductions to contractors, architects, and surveyors

Utility setup and local service coordination

Resale and long-term investment planning

Our goal is to provide hassle-free ownership and protect the long-term value of your investment.

One of Nevis’ leading independent real estate firms

Strong international buyer representation experience

Broad property portfolio beyond resort-only inventory

Trusted network of legal, construction, and CBI professionals

Long-term relationship focus, not just transaction support

If you are considering purchasing property in Nevis, we invite you to speak with our team. We are happy to provide confidential guidance, market insights, and tailored property recommendations.

Contact Nevis Style Realty today to begin your journey.